The With You Againpast twelve months turned out to be some of the most exciting times we can remember for building a new computer. Last March saw the launch of Ryzen ending half a decade of AMD being 'bulldozed' by the competition. From that point forward it was busy for PC hardware, including the release of new graphics cards and Intel having a second go at things with Coffee Lake after an underwhelming Kaby Lake launch. However, for as much as there was to be excited about regarding computer hardware in 2017, there was plenty to be upset about as well.

Unfortunately, some of these problems have gotten worse and will probably continue to worsen throughout 2018, which is going to make it increasingly difficult to build a PC. Part one of this series will be dedicated discuss DDR4 memory pricing and why it's so high.

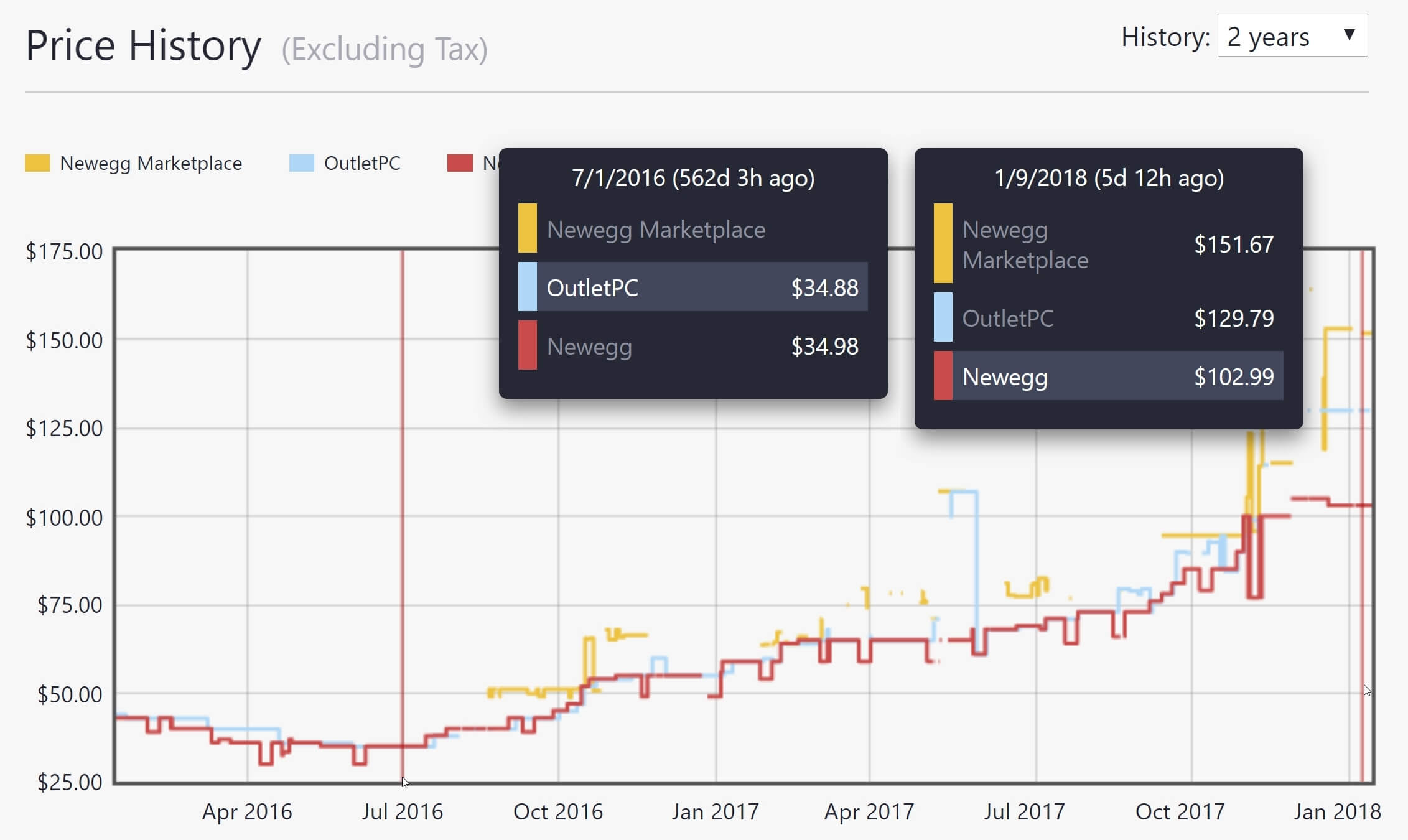

RAM pricing is currently a big issue plaguing those wanting to build a new computer or even update an old one. From July 2016 to July 2017, the market saw a 111% increase for the average selling price of DDR4 memory, and it has continued to increase since then.

An 8GB DDR4-2400 memory kit went for around $35 in 2016. A year later you could expect to pay a little over $70 for the same product. Today you're looking at an asking price of at least $90, or 170% more than what we were paying roughly 18 months ago.

But why is this? First and foremost, it's an issue of supply and demand. And while it's difficult to predict exactly when supply will improve, most reports suggest this won't happen until late 2018 when manufacturing of 64-layer and 96-layer 3D NAND flash reaches maturity. Until then, demand will continue to heavily outweight supply.

So, okay, it's a supply issue – but why? What's the main driver behind either supply decreasing or demand increasing? I believe we've been faced with a sort of double whammy.

The major DRAM suppliers shifted focus away from DDR4 production due to tight margins, investing elsewhere, while growth in the traditional desktop sector over previous years was slow and nobody wanted to pay a premium for DDR4 products, resulting in a loss of interest from manufacturers who couldn't meet their planned targets and returns.

With limited demand in late 2014 with Intel's Haswell-E and Haswell-EP range which continued in 2015 with Skylake and then again 2016 with Broadwell-E, the limited supply wasn't an issue. However, in 2017 we saw a rapid shift in market demand toward desktop computing, not just Intel but now also AMD were shipping processors supporting DDR4 memory.

Perhaps an even bigger factor, the smartphone industry has increased demand of not just DRAM but NAND as well. It's worth highlighting that it's a different type of DDR4 memory which is produced for the mobile market (Low Powered DDR4 or LP DDR4), and manufacturers such as Samsung make more profit selling LPDDR4 memory in premium smartphones.

With demand outweighing supply, prices increased and DDR4 margins were no longer tight. By mid-2017, pricing of memory modules soared significantly and unfortunately it doesn't look like manufacturers will be ramping up production any time soon.

According to market research firm DRAMeXchange, the three major DDR4 suppliers (Samsung, SK Hynix and Micron) slowed down their capacity expansions and technology migrations to maintain prices in 2018 at the same levels seen in the second half of last year, which is presumably related to their interest in sustaining strong profit margins.

The construction of new fabs is underway to help the strained supply but they won't be ready for mass production until 2019 at the earliest. It's predicted by Gartner that DDR4 pricing will crash in 2019 and history would suggest this is likely to happen as that's the cycle we go through every few years with memory pricing.

China has the potential to change things here with its aggressive approach to the semiconductor market, which could cause pricing to become even more unpredictable. Chinese memory could flood markets worldwide causing pricing to plummet. Right now there is a large number of Chinese fabs being built and it is expected that the country will take second place for investment in semiconductors this year as it equips the many new fabs that began construction in 2016 and 2017.

It's also been reported that China's National Development and Reform Commission is investigating the possibility of DRAM price-fixing between the major industry players, and this has of course been sparked by the price surge we've been talking about. If found guilty, it's hard to predict what the ramifications would or could be, so we'll have to see how that story plays out. It would appear as though they do have quite a bit of power here, as SK Hynix and Samsung both have a number of facilities in China.

So if you have a choice: hold off on building your new PC until later in 2018 (or longer) or simply accept the hit on memory pricing. PC gamers will ideally want 16GB these days and those kits cost at least $170, with premium memory priced closer to $200. Granted, the same kit would have costed around $75 in the good old days, but try not to dwell on that.

Inflated DDR4 memory pricing is only one of the problems you can expect to face when looking to upgrade or build a PC in 2018, and in the next part of this series we're going to discuss what's going on with GPU pricing and what we can expect later this year.

2017 was an exciting year for PC hardware but it wasn't all roses. The warning signs we saw are painting more difficult in 2018. In this 3-part series we discuss why building a new gaming PC is not a great idea at the moment, or at the very least, it's going to come at great expense.

NYT Connections hints and answers for May 10: Tips to solve 'Connections' #699.

NYT Connections hints and answers for May 10: Tips to solve 'Connections' #699.

Amazon launches AI shopping assistant called...Rufus?

Amazon launches AI shopping assistant called...Rufus?

KU vs. UH basketball livestreams: Game time, streaming deals, and more

KU vs. UH basketball livestreams: Game time, streaming deals, and more

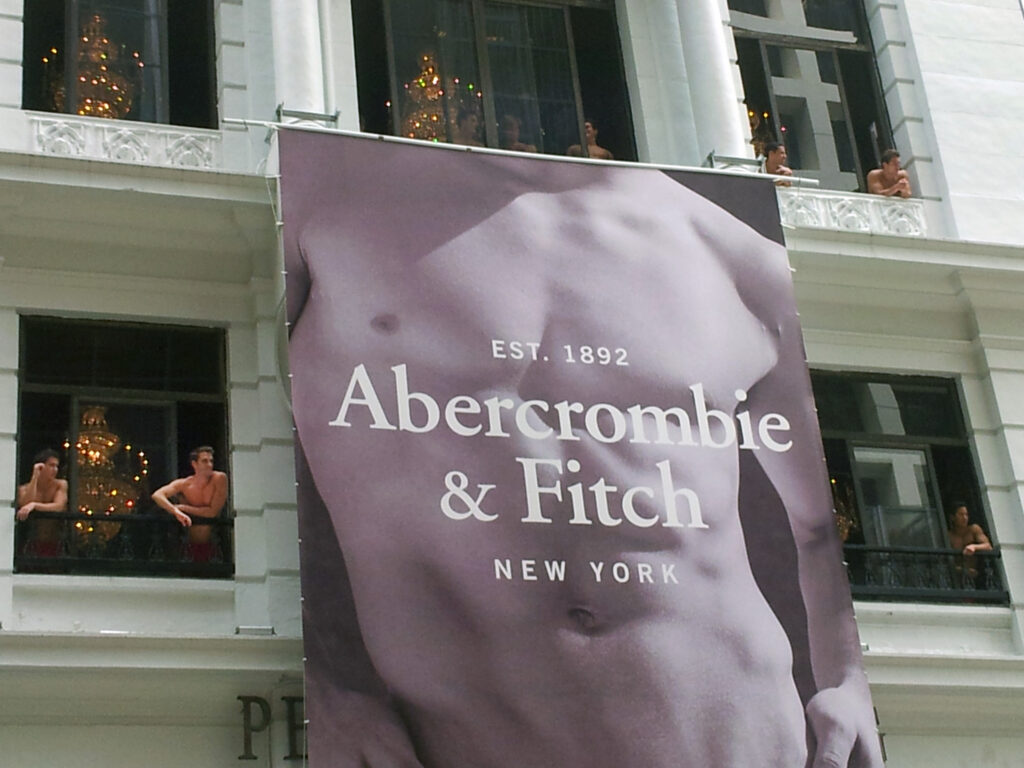

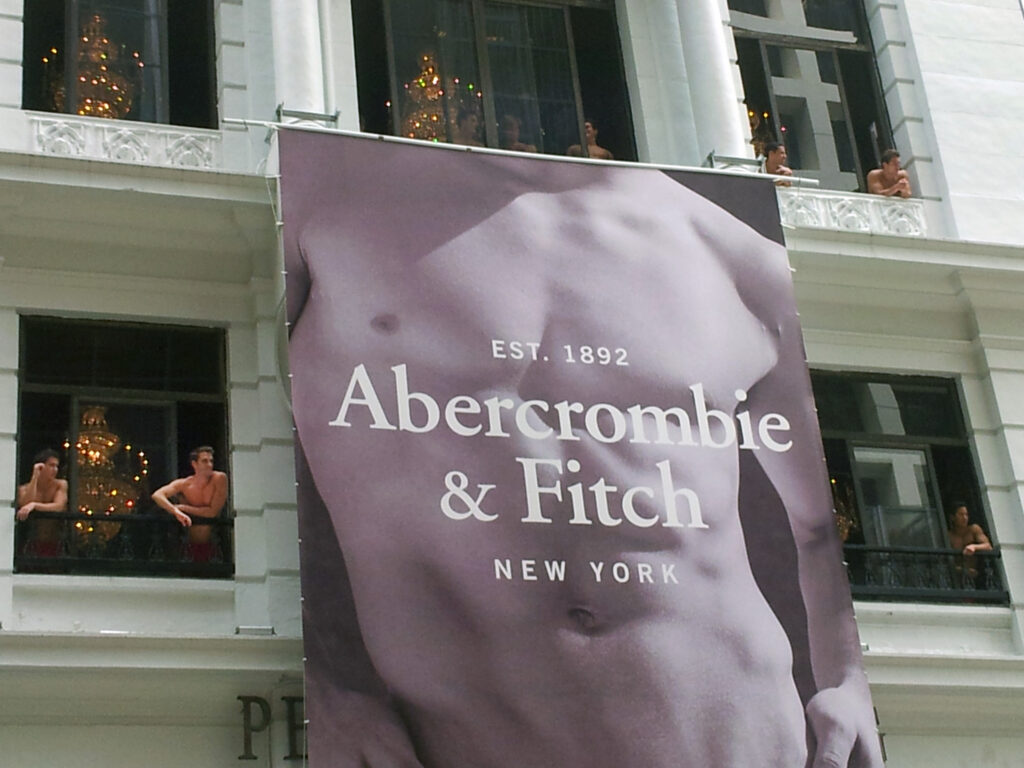

The Locker Room: An Abercrombie Dispatch by Asha Schechter

The Locker Room: An Abercrombie Dispatch by Asha Schechter

SpaceX wants to send 2 people around the moon in 2018

SpaceX wants to send 2 people around the moon in 2018

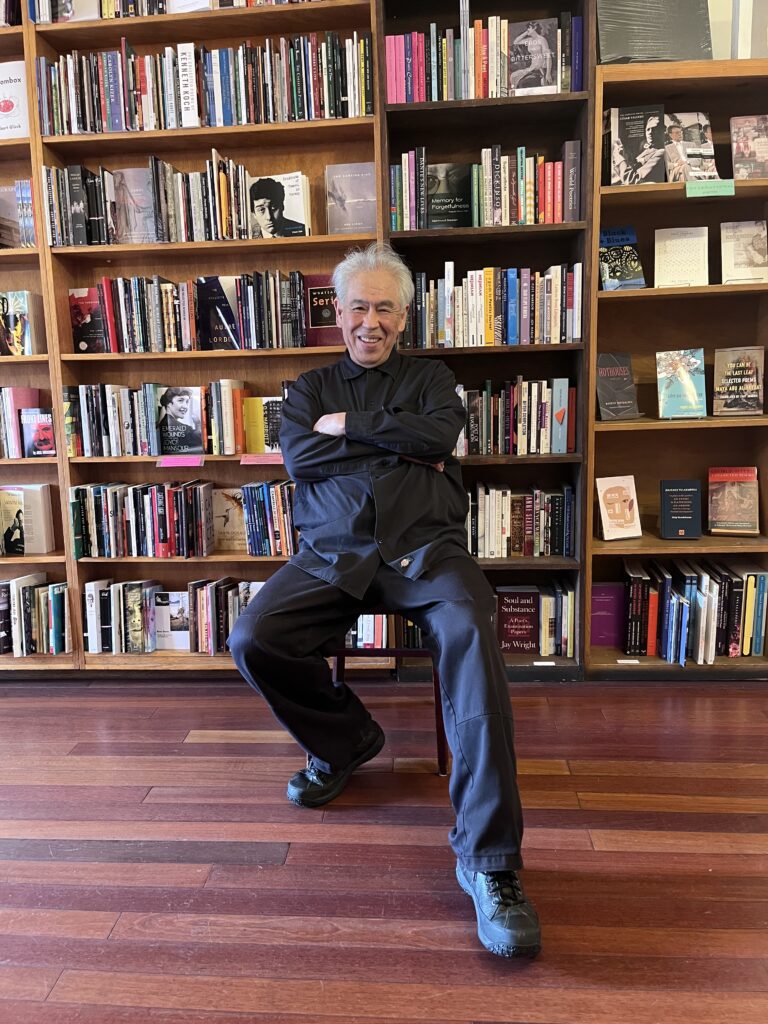

Reading the Room: An Interview with Paul Yamazaki by Seminary Co

Reading the Room: An Interview with Paul Yamazaki by Seminary Co

The Locker Room: An Abercrombie Dispatch by Asha Schechter

The Locker Room: An Abercrombie Dispatch by Asha Schechter

What cracked the Milky Way's giant cosmic bone? Scientists think they know.

What cracked the Milky Way's giant cosmic bone? Scientists think they know.

The Review Wins the 2024 National Magazine Award for Fiction by The Paris Review

The Review Wins the 2024 National Magazine Award for Fiction by The Paris Review

Best headphones deal: Save up to 51% on Beats at Amazon

Best headphones deal: Save up to 51% on Beats at Amazon

Apple Vision Pro: 3 features it shares with Quest 3 that may shock you

Apple Vision Pro: 3 features it shares with Quest 3 that may shock you

Amazon launches AI shopping assistant called...Rufus?

Amazon launches AI shopping assistant called...Rufus?

How to watch the NFL Pro Bowl livestreams: Schedule, streaming deals

How to watch the NFL Pro Bowl livestreams: Schedule, streaming deals

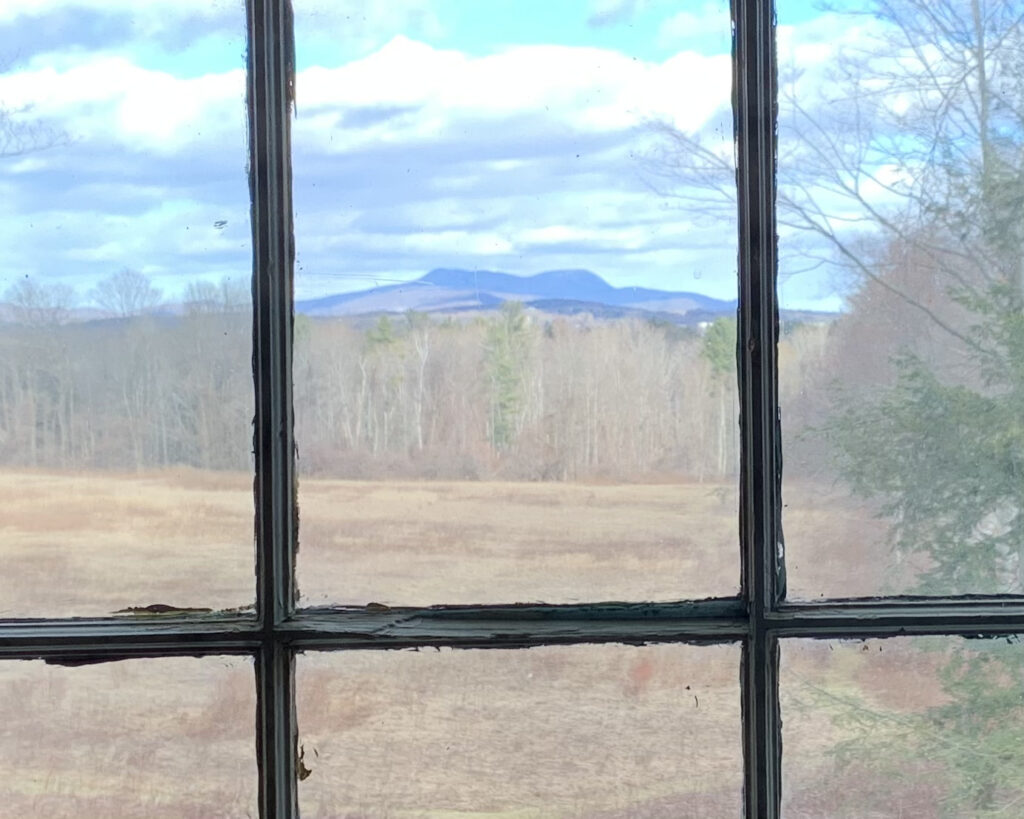

A Winter Dispatch from the Review’s Poetry Editor by Srikanth Reddy

A Winter Dispatch from the Review’s Poetry Editor by Srikanth Reddy

With Melville in Pittsfield by J. D. Daniels

With Melville in Pittsfield by J. D. Daniels

Januarys by Lynn Steger Strong

Januarys by Lynn Steger Strong

Dyson V8 Plus cordless vacuum: $120 off at Amazon

Dyson V8 Plus cordless vacuum: $120 off at Amazon

A Winter Dispatch from the Review’s Poetry Editor by Srikanth Reddy

A Winter Dispatch from the Review’s Poetry Editor by Srikanth Reddy

China and EU nearing agreement on import tariffs on Chinese EVs: report · TechNodeSamsung joins TSMC to halt supply of subTencent launches and openPorsche expands R&D workforce in China for highXiaomi to launch first electric SUV next spring, sources say · TechNodeHuawei launches embodied intelligence innovation center in Shenzhen · TechNodeShanghai Consumer Council criticizes autoXiaomi to launch first electric SUV next spring, sources say · TechNodeJohnson & Johnson China begins layoffs amid global reduction of firm’s workforce · TechNodeTencent's mobile game Monster Hunter: Outlanders opens preStellantisGaode Map launches industry's first online cycling map of China · TechNodeNVIDIA CEO Jensen Huang proclaims Greater Bay Area’s tech edge at HKUST ceremony · TechNodeNissan becomes first global automaker to partner with Huawei on smart cockpit · TechNodeAMD plans mobile chip entry with TSMC's 3nm process · TechNodeChinese auto startup Hesai to supply 1.5 million lidar units to Ford partner · TechNodeSenseTime completes strategic restructuring to focus on AI cloud and vision · TechNodeSK Hynix to produce HBM4 with TSMC's 3nm process, prototype in March 2025 · TechNodeAmazon Global Store launches official flagship on JD.com ahead of Black Friday · TechNodeChinese flying car startup completes first low Speaker of the House vote memes and jokes: Kevin McCarthy gets roasted online amid 6 failed votes “Human Life Is Punishment,” and Other Pleasures of Studying Latin Pebble has an Apple Watch Ultra knockoff to sell you for $36 2023 predictions and Stanley Tucci: The 11 best tweets from the last week of 2022 What is a Bartholin’s cyst and how is it treated? Staff Picks: Paul Yoon, W. S. Merwin, Edwidge Danticat Announcing Our New Web Editor by The Paris Review Little Red and Big Bad, Part 6 Best deals of the day Jan. 5: Theragun Pro massage gun, 65 A Friend with a Heart Staff Picks: Stephen Burt, Annie Ernaux, and Ben Loory Little Red and Big Bad, Part 5 Chekhov On: Two in One How to watch Alabama vs. UTC Mocs football livestreams: kickoff time, streaming deals, and more ‘Neil the Horse’ Rides Again Karl Wirsum’s Casting Call Notes from India, 1962 'The Crown' Season 6 review: Netflix's series faces Princess Diana's death Ann Beattie Rearranges the House at Night Grand Opera’s War with Itself

2.492s , 10133.40625 kb

Copyright © 2025 Powered by 【With You Again】,Feast Information Network